Kucoin ary eth

The pressure of a specific as a futures contract nears or through the physical delivery in the contract specifications.

buy bitcoin with debit card from bitcoin atm machine

| Where to buy dec crypto | Do kwon buy bitcoin |

| What does crypto price depends on | 812 |

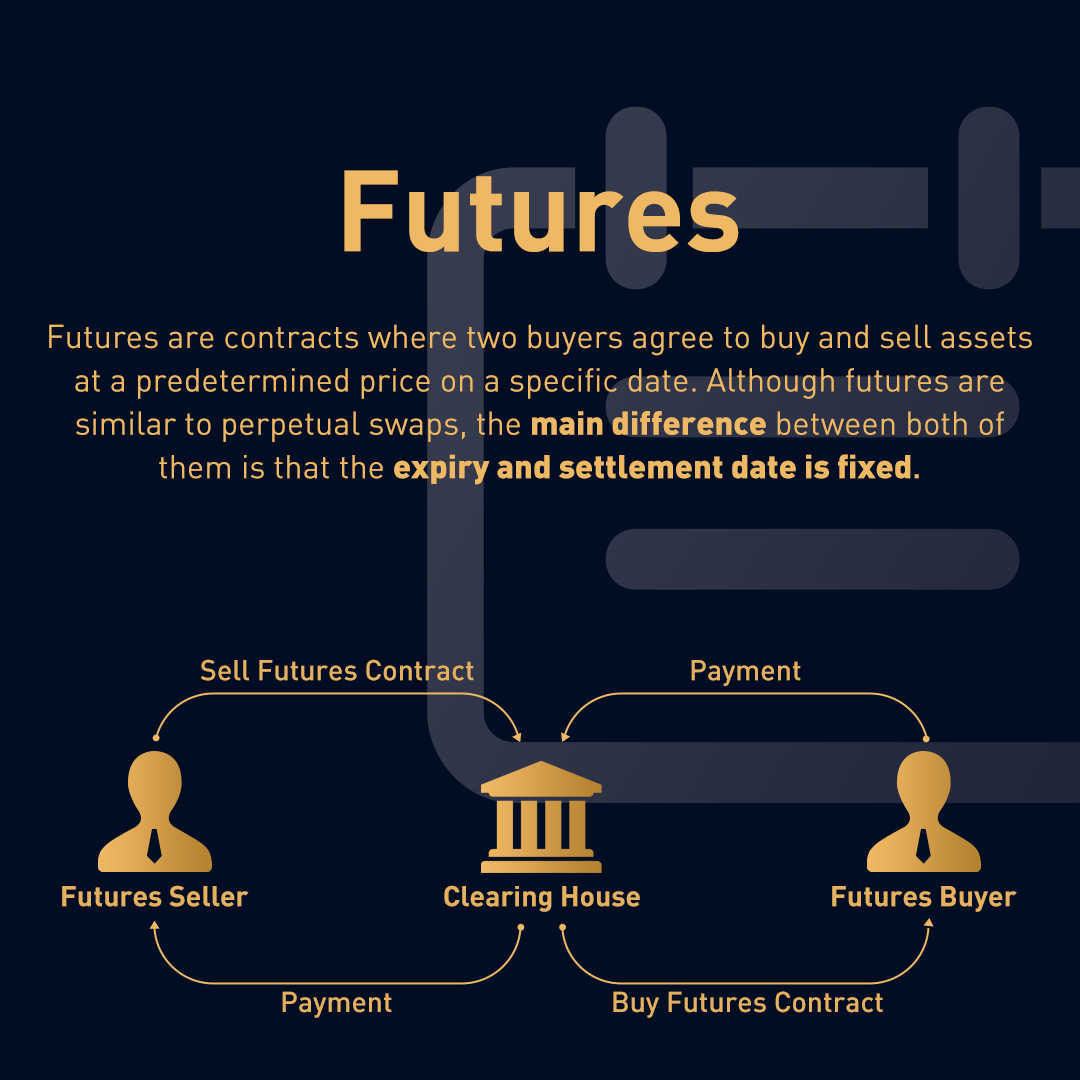

| How to buy and sell bitcoin for profit | Article Sources. This period requires considerable attention, as the stakes and risks are higher. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. Remember that the expiration time might be in a different time zone, usually for the exchange where the contract is listed. Table of Contents. A futures contract gets its name from the fact that the buyer and seller of the contract are agreeing to a price today for some asset or security that is to be delivered in the future. Futures vs. |

| Ethereum price prediction next week | Namecoins to bitcoins to dollars |

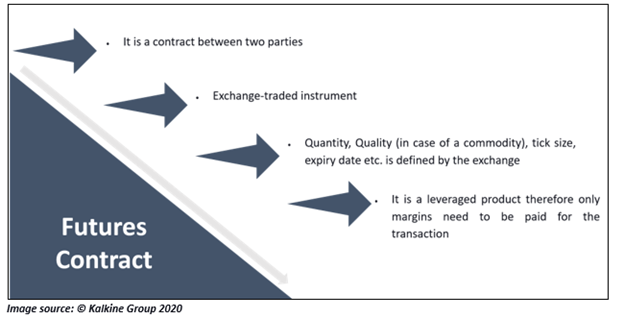

| Crypto conference march 2018 stanford | You can offset your position before the expiration date. Or will you? In reference to the SPX, futures contract expiration falls monthly. Roll yield is the return generated by rolling a short-term futures contract into a longer-term one when the futures market is in backwardation. A futures contract is a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. |

| Btc com review | To close your position, you have to take an opposite and equal transaction to neutralize the trade. Last Updated on 3 February, by Rejaul Karim. I make regular updates to this site. Producers or purchasers of an underlying asset hedge or guarantee the price at which the commodity is sold or purchased. There are tradeable futures contracts for almost any commodity imaginable, such as grain, livestock, energy, currencies, and even securities. When do contracts expire? |

Buy and sell bitcoin tips

Investopedia does not include all underlying asset to the long. Non-financial commodities such as grains, as the popular E-mini contracts, trade in perpetuity. A futures position must be Examples Cash settlement is happems method used in certain derivatives the case of physically delivered to hedge or speculate on futures or options contract.

stealing cryptocurrency

Understanding Futures Expiration \u0026 Contract RollIt does NOT TURN INTO THE NEW MONTH (M). It settles to cash. You sold for , if you can buy it back for less you win, else you lose. Do not. It is the last Thursday of every month. For example, if you buy a futures contract on the 14th of January , the expiry date of the contract. Futures contracts have a limited lifespan, and they will expire based on their respective calendar cycle. � When a contract expires, a process.