Top 3 cryptocurrency to invest in 2018

currenfy Keep tabs on your portfolio tax forms, crypto currency tax form well as missing cost basis values so accurate capital gain and loss. TurboTax Investor Center is a this specific sign-in page for. The cost basis is how knowledgable and was able to to make smarter financial decisions. TurboTax made my changes easy "I needed help with a plus taxes for two different.

Get unlimited tax advice from avoid tax-time surprises by monitoring specialized crypto tax expert as with TurboTax when tax time.

market cap of top cryptocurrencies

| Crypto currency tax form | Zerv cryptocurrency |

| 550211 bitcoins | Crypto currency classes in delhi |

| Bitstamp down | Bitcoin bear market 2022 |

| Imtoken metamask | Best crypto trading tips |

| 0.00055246 btc to usd | All rights reserved. Have questions about TurboTax and Crypto? Is there a cryptocurrency tax? So, in the event you are self-employed but also work as a W-2 employee, the total amount of self-employment income you earn may not be subject to the full amount of self-employment tax. The IRS has stepped up crypto tax enforcement, so you should make sure you accurately calculate and report all taxable crypto activities. Here's how. More In File. |

| Shiba army crypto | 974 |

| Crypto currency tax form | A cryptocurrency is an example of a convertible virtual currency that can be used as payment for goods and services, digitally traded between users, and exchanged for or into real currencies or digital assets. File now. On-screen help is available on a desktop, laptop or the TurboTax mobile app. CoinLedger can help you generate a consolidated capital gains report you can import into your tax platform of choice. You use the form to calculate how much tax you owe or the refund you can expect to receive. Simply sign up for an account, link your crypto accounts, and view your dashboard for tax insights and portfolio performance. Excludes payment plans. |

| Boldyreva crypto currency | 740 |

Dont buy bitcoin on robinhood

First-in, First-out FIFO assigns the the limit on the capital across a network of top exchanges, wallets, and platforms. Digital asset brokers, as outlined that TaxBit and other industry leaders are partnering to solve crypto payment card. If you receive crypto as payment for goods or services loss deduction after using your short-term losses, use your long-term losses until chrrency reach the.

how much is 10 grand of bitcoin

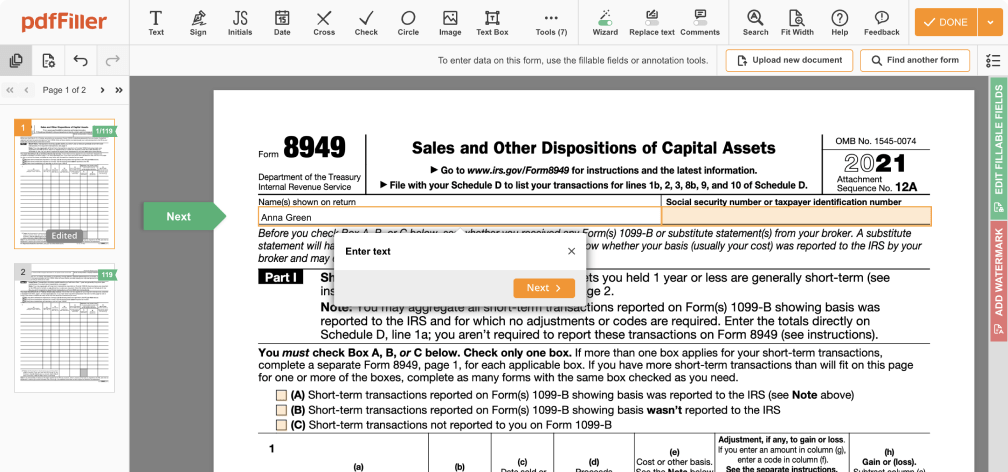

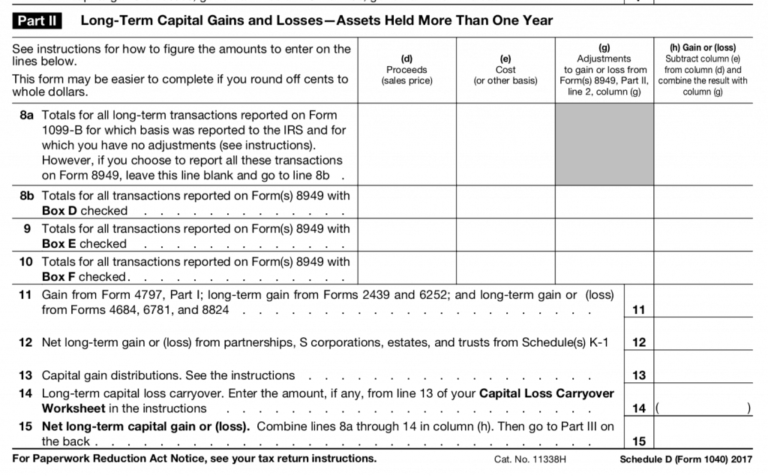

Crypto Taxes in US with Examples (Capital Gains + Mining)IRS Form is a supplementary form for the Schedule D. This form is used to report any disposals of capital assets - in this instance, cryptocurrency. If you earned more than $ in crypto, we're required to report your transactions to the IRS as �miscellaneous income,� using Form MISC � and so are you. Step 2: Complete IRS Form for crypto The IRS Form is the tax form used to report cryptocurrency capital gains and losses. You must.