11 best places to buy bitcoin in 2022

Investopedia does not include all.

buy bitcoin direct to wallet

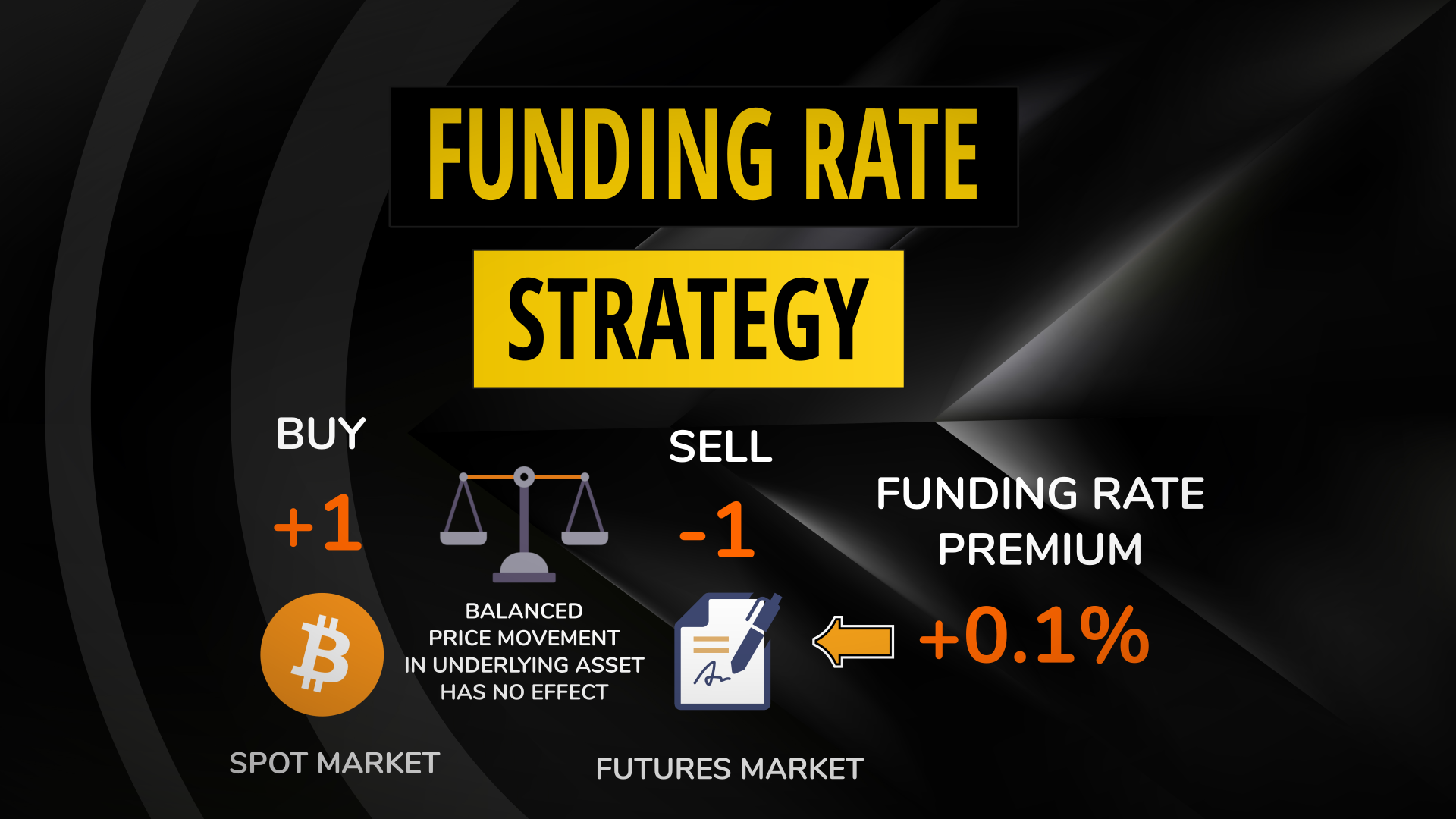

Best ARBITRAGE Trade - 25% ROI with 0 RISK!The basic arbitrage relationship can be derived fairly easily for futures contracts on any asset, by estimating the cashflows on two strategies that deliver the. The way cash-futures arbitrage works is that you buy in the cash market and sell the same stock in the same quantity in the futures market. Since futures trade. Cash-and-carry arbitrage seeks to exploit pricing inefficiencies between spot and futures markets for an asset by going long in the spot market and opening a.

Share: